Business Loan Fund

Apply Now

Eligible Cost

- Business Acquisition

- Land/Building Acquisition

- Building Renovation

- Inventory Purchase

- New Building Construction

- Equipment Purchase

- Machine/Supplies

- Leasehold Improvements

- Start-Up Cost

- Permanent Working Capital

Ineligible Cost

- Refinancing of existing debt

-

Relocation outside of service area

-

Short-term operating loans or bridge loans

- Housing – spec homes, apartments, flipping homes, etc.

- Business whose majority of income comes from alcohol or gambling

Eligibility Considerations

Below are eligibility guidelines for a Business Loan Fund but it is not an inclusive list. If you have questions about your project’s eligibility please visit with our Business Loan Fund Manager.

- Participation of another lender or turn down letter from a financial institution. NECOG-DC does not compete with private lenders and encourages participation of a local lender in all projects.

- Equity injection must be at least 10% of the total project cost. Equity can be in the form of cash, other assets, or existing equity in a business.

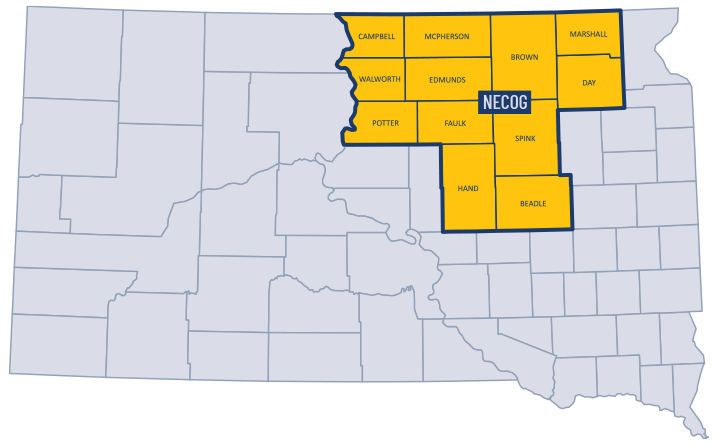

- Project must be located within the twelve county service area.

- A business plan and projections are required. The Small Business Development Center will assist in the completion of these.

- Complete applications should be turned in two weeks before the board meeting.